5/1/2023

The Cost of Indoor Farming

H. Christopher Peterson, Simone Valle De Souza and Joseph Seong

In the fourth article, we took on the outward-looking task of consumer willingness to pay, which is central to indoor farming revenue generation. This fifth, bonus article in the series on frequently asked questions (FAQs) will look inward to the topics of capital costs, operating costs, profitability and contributing factors to indoor farm failure.

Some cost analyses were extracted from the OptimIA Economics Team’s economic modeling of indoor farms. The lack of publicly available financial data on the U. S. industry’s companies and the wide variation in farm size, technology implemented and growing practices make our answers more general than we would prefer, but we think they’ll provide insights, nonetheless.

Q: What are the largest capital and operational costs for indoor farming?

A: This question is in one sense straightforward on the capital side. The largest costs are for technology, including plant growing infrastructure (trays, towers, HVAC and delivery systems for light, water and nutrients), controls (computers, sensors and software to optimize the plant environment), and plant harvesting and marketing equipment. Buildings and property are also key capital costs that can be managed by rents and leases as opposed to outright ownership.

What complicated the capital side arises from little standardization in growing infrastructure and controls, particularly with the increasing number of more efficient and less costly alternatives being developed by industry suppliers. Capital costs vary widely depending on the system components and how they’re integrated. To counterbalance the nevertheless still high capital cost of integrated control, farms need to offset it with efficiencies in operating costs (energy and labor most especially), enhanced plant output, and quality and revenue enhancement based on market prices that realize the value of output attributes (taste, freshness and consistency in supply).

As opposed to capital costs that are accounted for as balance sheet assets, operational costs are the daily costs needed to run the business and turn out marketable produce. Labor, energy and consumables (growing media, seeds, water, etc.) are the big three.

In the firm’s income statement, the fourth critical operating cost is depreciation that represents the consumption of capital costs over time. Just as with capital costs, operational costs vary widely depending upon the production system implemented. More automation (capital cost) can lower operational labor costs and plant growing costs. Conversely, more labor can substitute for more capital. The labor/capital tradeoff is one of the classic economic issues for any business organization and not just an indoor farm.

Q. What percentage of total operating costs does energy account for an indoor farm?

A: Operating costs in indoor farms can be as significant as capital investments, particularly in what it relates to energy costs, which is generally the second highest operational variable cost after labor. Such as in the discussion about capital costs, various factors can affect energy costs.

An important factor to consider is the relative benefit of investing in energy-efficient lighting and HVAC systems, and any other electricity powered systems, along with other structural farm design. Larger investment in higher-quality systems will affect operating fixed costs through depreciation of capital investment, but compensates on operating variable costs through electricity consumption. Electricity costs also vary between systems and farm structural design, and according to growth schedule planned for the production in terms of harvest cycle length, daily light integral and light intensity. Indoor farms have reported to have electricity costs accounting for around 30% of their operating variable costs.

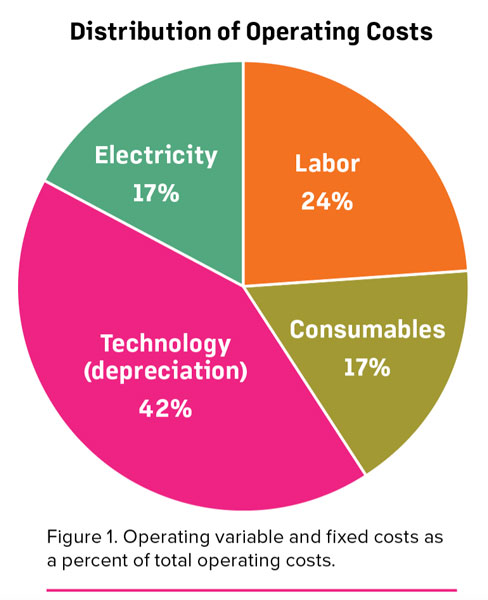

As an example, the OptimIA modeling team has recently developed a model for an indoor farm with 800 square meters growing area, operating with a 16-hour photoperiod and using light intensities of 140 μmol/m2/s before and 200 μmol/m2/s after transplanting and harvesting lettuce on the 20th day after transplanting, and electricity costs accounted for 29.2% of total operating variable costs. If we compare the fixed operating costs associated with technology depreciation (at $146/m2 per annum), electricity consumption represented 17% of these operating costs, while technology depreciation accounts for 42% (Figure 1).

The unit price paid for electricity consumption is an important contributor to the large variability in energy costs across farms. In the OptimIA study, annual operating variable costs would increase by almost one dollar per square meter for each 1% increase in prices for electricity per kWh. That’s an important consideration when growers are selecting farm site or benchmarking.

The unit price paid for electricity consumption is an important contributor to the large variability in energy costs across farms. In the OptimIA study, annual operating variable costs would increase by almost one dollar per square meter for each 1% increase in prices for electricity per kWh. That’s an important consideration when growers are selecting farm site or benchmarking.

Average U.S. electricity costs were $0.144 in September 2021, but electricity prices could be as low as $0.117 in Seattle or $0.121 in Miami and as high as $0.30 in Hawaii and $0.35 in San Diego. Electricity prices are also subject to fluctuations as the industry has seen recently. In September 2022, electricity prices ramped up to as high as $0.409 in San Diego and $0.474 in Hawaii, taking the national average to $0.167/kWh. These increases, which were mostly driven by higher natural gas prices (U.S.-EIA, 2022), may fall back as natural gas-fired electricity generation in the U.S. is expected to fall in 2023, but that’s still to be confirmed.

Q. What are vulnerabilities that contribute to the failure of indoor farming operations?

A: We hope that the entire series of FAQs have contributed to answering the opposite question: What would make an indoor farm successful? However, examining failure can also be useful. As we said in the opening about lack of real-world data, we have less in-depth research into indoor farm failure than we would like to answer this question. The contributions to failure arise from some key vulnerabilities in indoor farm operations:

1. Too much capital investment for the revenue and profit streams generated. As is true in many emerging industries, fascination with the newest technology and its long-term potential leads to over-investment and unrealistic expectations in the short-term, particularly when the technology is not yet standardized for economic profitability. The presumed profit benefits of economies of scale drive big investment before the technology is reliably scalable. Compounding the problem are revenue streams that aren’t sufficient to support investment payback. Incumbent firms in field farming and greenhouse production aren’t going to cede market share to a new technology just because it has long-term potential. With their sunk investments and proven profit models, they can compete effectively to defend their revenue streams and minimize indoor farming revenue gains. Indoor farms need to more carefully manage return on investment (ratio of profit to investment) in order to not overestimate the profits that can arise from the capital cost of new technologies.

2. Too little control over the inputs and outputs of the growing process and how that translates into profitability. Indoor farming has the potential to be exceedingly efficient in transforming inputs into outputs. To achieve this efficiency ultimately requires full control over the environment in which the plant grows. We speculate that most (if any) indoor farms have not achieved this level of control. Agriculture generally is an industry in which biology creates uncertainties in production that no other industry faces. In agriculture, one can do everything right managerially and still have subpar output (and bad profits) because of biological interference (pests, insufficient water or other inputs, bad weather and the list goes on). Indoor farming proports to mitigate biological and climatic uncertainties. But the fully controlled system hasn’t been built yet (think tip burn writ large). Now connect the loss of control to the costs and prices of wasted inputs and less marketable outputs. Economic failure is far too easy to envision.

3. Too much focus on yield and cost versus product attributes and profitability. Agriculture generally has suffered far too long from a “commodity mentality”— grow huge volumes of stuff and sell it at prevailing prices. The only farms that win at this game are low-cost producers. Every other farm fails. The successful commodity farmer only needs to know two things: yield and price. They can assure profitability from there based on best management practices. We’ve seen too many indoor farms focus on maximizing yield and minimizing costs as if they were selling commodities. That doesn’t work when you’re not a low-cost producer.

Indoor farms often have both a capital cost disadvantage and an operating cost disadvantage versus field and greenhouse operations. The advantage of indoor farming is enhanced product attributes because of greater control. Indoor farms must market these enhanced attributes to generate higher prices that translate into higher profits. Attributes and profits result in success, not yields and costs.

CHRIS PETERSON is a Professor Emeritus in the Department of Agricultural, Food, and Resource Economics at Michigan State University; SIMONE VALLE DE SOUZA is an assistant professor in the Product Center Food-Ag-Bio and JOSEPH SEONG is a Ph.D. student at Michigan State University under the advisement of Dr. Simone Valle de Souza. This project is supported by USDA-NIFA Specialty Crop Research Initiative (SCRI) award no. 2019-51181-30017.

Cited reference: U.S. Energy Information Administration (EIA) (2022). Short-term Energy Outlook. Release Date: Feb 7, 2023. Retrieved from: https://www.eia.gov/outlooks/steo/report/electricity.php

Previous FAQ Stories

You can find the FAQ series from OptimIA researchers in the following issues of Inside Grower:

Part 1: May 2022

Part 2: August 2022

Part 3: November 2022

Part 4: February 2023