2/1/2023

Questions About Consumer Behavior

H. Christopher Peterson, Simone Valle De Souza & Joseph Seong

The ultimate success of indoor farming will hinge on consumer acceptance of its produce quality and price versus conventional field and greenhouse offerings.

Q: Are consumers willing to pay more for local indoor leafy greens?

A: This question is complicated. Consumer willingness to pay (WTP) for a product depends on various factors. Looking through the lens of marketing analysis, a combination of various social and psychological factors defines consumer preferences between quality traits and the value they assign to a product. Consumers could be willing to pay a premium for the “functional value” associated with the health benefits from eating fresh and nutritious leafy greens grown without pesticides in an indoor farming system.

Similarly, locally grown leafy greens can attract “social value” by connecting consumers within a group that values promoting local economic development or supporting local farmers. “Social value” can also be associated with indoor farming for its environmentally friendly production system.

Overall, WTP derives from a combination of consumer preferences for quality traits or attributes, the value they attribute to them and their ranking of these attributes in the allocation of their disposable income.

The research

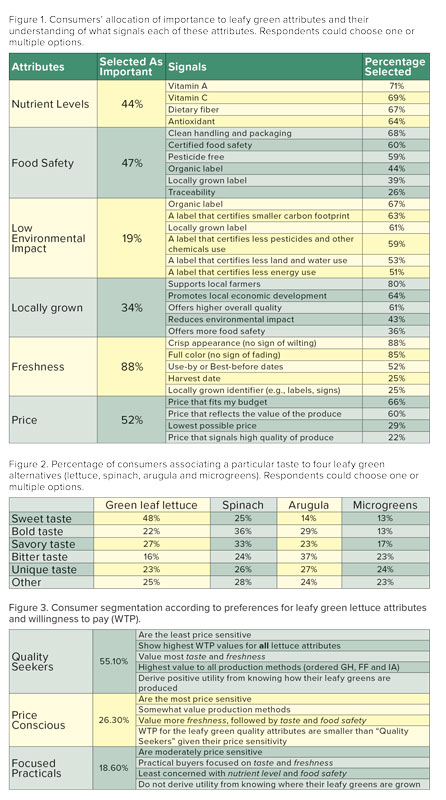

The OptimIA Economics Team recently completed a consumer survey of a representative sample of 2,114 U.S. leafy green consumers. The team identified consumer preferences for leafy green attributes (Figure 1).

The most important attribute for these consumers was freshness, which consumers identified to be mostly signaled by a crisp appearance and full color. The second most important attribute when purchasing leafy greens was stated to be taste (Figure 2), but that’s a more complex attribute.

Survey respondents were asked to identify the taste they look for when purchasing a set of four of the most popular leafy greens. Almost half of lettuce consumers prefer a sweet taste in lettuce, but another 27% prefer lettuce with a savory taste and 22% also choose a bold taste. Arugula is preferred bitter and bold, while spinach is preferred with a bold and savory taste.

Returning to Figure 1, another interesting finding is that price (third most important attribute) is mostly seen as “the price that fits their budget” and only 22% associate price with quality of produce. The least important leafy green attribute was low environmental impact in producing leafy greens. The 19% of consumers that indicated that a low environment impact was an important attribute see it as signaled by a number of factors, including organic label, locally grown and less pesticides. Locally grown was only chosen by 34% of consumers. Locally grown was less important than expected. Nutrient levels and food safety were selected by 44% and 47%, respectively.

To identify how consumers rank their preferences in relation to their disposable income, the Economics Team designed a choice experiment that simulated a real-life lettuce purchasing scenario. Each participant was presented with six combinations of leafy green products and asked to select the one they wanted to purchase. They also had the choice to not purchase any of the products offered. Participants could choose to purchase leafy greens grown in Indoor Farms, Greenhouses or Field Grown, with combinations of three levels (between “OK,” “good” and “very good”) of taste and freshness, added nutrient levels varying between none, 20% or 50% more, and a label that, when present, certified the produce for food safety. Prices were allocated randomly throughout experiments, reflecting market prices for differentiated produce grown in greenhouses and IA farms, and nationally reported data on field-grown lettuce prices.

Results: Taste & freshness rule

Aggregated results showed consumers deriving value from all quality attributes, particularly from taste and freshness, as indicated by the survey section defining preferences for attributes. However, consumers indicated, on average, a slightly higher WTP for taste than freshness. WTP is estimated for each individual in the sample and reported as the mean dollar value for a marginal increase in that quality attribute sold. In this case, consumers generally would be willing to pay a $2.29 premium on a 4.5-oz. product offering for better taste and a $2.27 premium for fresher lettuces.

But consumer WTP also depends on who is “the consumer.” Consumers are individuals with particular preferences, which are affected by social and demographic characteristics. Therefore, consumer WTP for leafy green lettuce was estimated based on a consumer segmentation. Three consumer classes were identified and named based on statistical analysis of preferences and WTP estimates (Figure 3), namely “Quality Seekers,” “Price Conscious” and “Focused Practicals.”

The first consumer segment (the majority of this sample, 55.1%) showed the highest WTP for all lettuce attributes, particularly for taste and freshness. These “Quality Seekers” derive the highest value from knowing how their lettuce is produced. The highest value of $5.21 was estimated for leafy green lettuce produced in Greenhouses, followed by a WTP of $4.61 for field-grown lettuce and $3.80 for a same sized IA-produced leafy green lettuce. This group of consumers preferred freshness over taste, willing to pay a premium of $3.46 for increments of freshness and $3.37 for taste.

The first consumer segment (the majority of this sample, 55.1%) showed the highest WTP for all lettuce attributes, particularly for taste and freshness. These “Quality Seekers” derive the highest value from knowing how their lettuce is produced. The highest value of $5.21 was estimated for leafy green lettuce produced in Greenhouses, followed by a WTP of $4.61 for field-grown lettuce and $3.80 for a same sized IA-produced leafy green lettuce. This group of consumers preferred freshness over taste, willing to pay a premium of $3.46 for increments of freshness and $3.37 for taste.

The “Price Conscious” segment was very price sensitive, once again valuing freshness over taste. Their price sensitivity is reflected in lower WTP for production systems, but they still show a positive value for knowing how their leafy greens are produced. Specifically, they were willing to pay $2.48 for field-grown, followed by $1.73 for greenhouse-produced and $1.61 for IA-produced leafy green lettuces.

The third segment identified in this study doesn’t derive any value from knowing how their leafy green lettuce is produced, but does value quality attributes, more so taste and freshness. This class was called “Focused Practicals” for their focused preference on a limited number of attributes. This segment of consumers is also the one who places the least values on nutrient levels and a food safety label on the produce.

Breaking down demographics

Further differences among consumers also arise from age and residence location. Millennials, defined as between 26 and 40 years old, form the group with highest WTP for IA- and GH-produced leafy green lettuce and a high WTP for quality attributes. The highest WTP for quality attributes alone was identified in the age group Gen Z, the youngest of the sample. Baby Boomers showed the lowest WTP for quality attributes and seemed to not associate any value with production systems.

Based on living areas, urban dwellers, about a third of these survey respondents, derived most value from knowing how their lettuce is produced, with a particular preference for field-grown lettuce. Favoring taste over freshness, urban dwellers are willing to pay the highest premium for quality attributes.

Communities living in rural areas, on the other hand, show the lowest WTP for quality attributes and indicate WTP a premium only for field-grown produce. Almost half of this sample resided in suburban areas and stated to not associate value with production systems, but rather with quality attributes, ranking freshness in first.

Our original question asked if consumers are willing to pay more for local indoor leafy greens. The answer is a qualified “yes.” No matter how they’re grown, leafy greens must first meet the highly valued consumer demand for freshness and taste. Indoor greens have the potential to exceed taste and freshness attributes delivered by field- and greenhouse-grown.

Currently, willingness to pay a premium for indoor is clearly seen in the survey results (especially for the “Quality Seekers” majority segment), but really high-quality field and greenhouse produce is also highly valued by consumers. Indoor produce needs to compete and deliver superior value to be paid more. The “local” attribute added to indoor is likely a plus, but locally grown in and of itself was only seen as an important purchasing attribute to one-third of the survey participants. For that one-third, local is likely critical to enhancing value. Urban and younger consumers would be most attracted to this attribute when coupled with superior taste and freshness.

Simone Valle De Souza is an assistant professor in the Product Center Food-Ag-Bio; Chris Peterson is a Professor Emeritus in Department of Agricultural, Food, and Resource Economics at Michigan State University and Joseph Seong is a PhD student at Michigan State University under the advisement of Dr Simone Valle de Souza. This project is supported by USDA-NIFA Specialty Crop Research Initiative (SCRI) award no. 2019-51181-30017.